What’s the concept, how much it can impact you

What is the concept, how much it can impact you

Impermanent loss is a concept used in DeFi, that shows the potential loss of providing liquidity to AMM (automated market making) exchanges, compared to holding the tokens. It is call “impermanent” (opposed to “permanent”) as it is not materialized up to retiring the funds of the liquidity pool. The impermanent loss may not be compensated by the fees earned providing liquidity.

This concept can be easier understood if we give an example — let’s assume we provide 100 USD and 1 ETH to a pool, where the exchange price is 1 ETH = 100 USD. I will assume extreme changes in price in order to make the concept clearer:

If the price of the ETH goes up to 1 ETH = 10,000 USD

– in the pool I will have 0,1 ETH and 1000 USD → in total, I have 0,1 ETH · 10,000 USD + 1000 USD = 2000 USD

– if I would simply hold the positions, I would have 1 ETH · 10,000 USD + 100 USD = 10,100 USD.If the price of the ETH goes down to 1 ETH = 1 USD

– in the pool I will have 10 ETH · 1 USD + 10 USD = 20 USD

– if I would simply hold the positions, I would have 1 ETH · 1 USD + 100 USD = 101 USD.

As it can be seen, impermanent loss (IL) happens anyway: if the price goes up or down, you would have more if only holding the positions. To the previous quantities, we need to add the fees collected as liquidity providers, but with such changes, it won’t make a difference. So HODL is a good option, but we would like to have a more active participation in the DeFi community, don’t we?

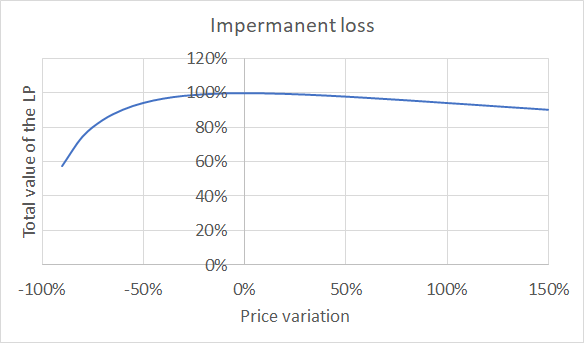

The IL can be modelled based on the formulas of the AMM. Assuming Uniswap v2 for easy explanation, the expected impermanent loss can be seen in the next graph:

where we can see that if the token increases a +50% the LP will be valued at 98%, so the impermanent loss is 2%, and if the token decreases to -50% the impermanent loss is 6% (the impermanent loss, as seen in the graph, is asymmetric)

If we hedge the position with a future, it is possible to reduce significantly that loss; if we model again the IL:

0 comentarios