Stablecoins are a very important part of decentralized finance.

Understanding what they are and how they work is crucial to being able to navigate well in the ecosystem.

Here is a clear and concise guide to stablecoins from the Growi.fi team.

Stablecoins are cryptocurrencies whose value is anchored to another asset, so that one unit of stablecoin is worth one unit of that asset.

The assets to which they are anchored are usually real-world assets such as fiat currencies or commodities.

They arise with the purpose of bringing stability and certainty in the crypto market, since before their existence this was something very difficult to find.

They fulfill the role of a means of payment within the ecosystem, assuring those who receive them that they will maintain their purchasing power in the short term.

Stablecoins are differentiated from each other by the asset to which they are anchored and how they are backed. The second factor gives rise to the classification of stablecoins into three main types.

Those backed by fiat money, those backed by cryptocurrencies and those backed by algorithms.

Stablecoins backed by fiat money

Behind these types of stablecoins are companies that maintain parity with the corresponding fiat currency by storing the money they earn from their operations.

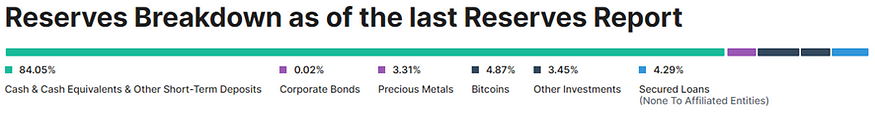

Most of their reserves are cash and equivalents.

The most commonly used fiat-backed stablecoin is USDT. The company that maintains the peg, Tether, has 84% of its reserves in the form of cash and equivalents and the rest in assets that can provide a higher yield.

Stablecoins backed by cryptocurrencies

As you can imagine, having reserves composed of dollars or euros is not the same as having reserves composed of cryptocurrencies, which have no fixed value.

We will use the functioning of DAI, the most widely used crypto-backed stablecoin to understand how it manages to maintain parity with the dollar. Maker DAO is the platform that is responsible for its backing.

Maker DAO relies on the principle of overcollateralization to back DAI correctly. When a user is going to deposit cryptocurrencies in Maker DAO to receive DAI, he has to deposit a higher value than he is going to receive in the form of DAI. For example, if he wants to receive 100 DAI (worth $100) he has to deposit cryptocurrencies worth more than $100. Depending on the cryptocurrency you deposit that value will be higher or lower.

It is very different from when the user performs this process in Tether to receive USDT. In this case he has to deposit the 100$ plus the commissions charged by Tether.

This way, Maker DAO makes sure that even if the cryptoassets backing DAI are volatile, there is always enough margin to maintain parity.

Algorithm-backed stablecoins

These are those backed by platforms that maintain the stablecoin’s parity with the underlying asset using algorithms.

The stablecoin’s supply is automatically modified by issuing or burning units when necessary.

They do not so much play with the value of their reserves (which they obviously have) but use algorithms and incentives to stabilize the stablecoin price.

While the other two types of stablecoins control the supply of units to maintain a parity of this with the reserves, algorithm-backed stablecoins control the supply to stabilize their price and the reserves do not play such an important role.

0 comentarios