How to use Uniswap’s concentrated liquidity, manage risk and profit from it

Within the decentralized finance universe, one DEX stands out among the rest. With unprecedented innovation in farming, Uniswap has established itself as the leading DEX in the DeFi landscape, reaching $3.5 billion in total blocked volume.

For those entering the DeFi world, understanding Uniswap thoroughly and learning how to maximize its performance becomes a priority. Currently, Uniswap v3 represents the latest operational version, although Uniswap v4 is expected to be released, which we will discuss in detail next week.

Uniswap v3 has revolutionized the practice of farming, inspiring numerous protocols that have adopted this model. In addition, it has managed to reduce exchange fees, bringing them down to 0.05% in many cases.

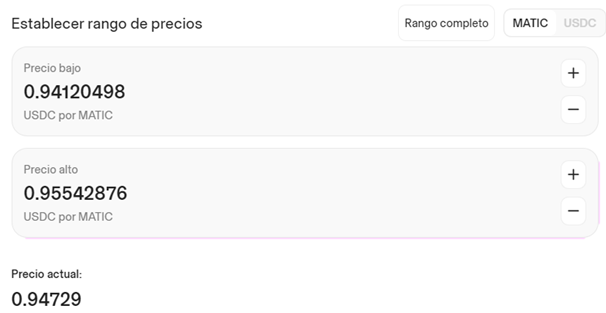

Compared to its predecessor, Uniswap v2, the most notable transformation is the introduction of concentrated liquidity. This change allows liquidity providers to concentrate their assets in the price range they deem most favorable, proportionally increasing the fees earned. However, it is important to keep in mind that as liquidity is concentrated, risk also increases; moving out of this range means no more commissions.

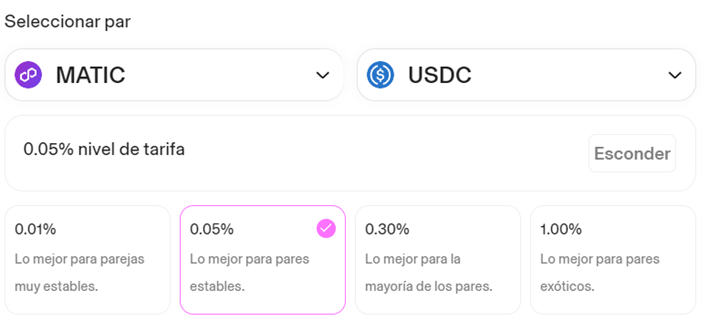

Another significant aspect is the different commission rates, which now vary from 0.01% to 1%, providing users with additional flexibility according to their preferences and strategies.

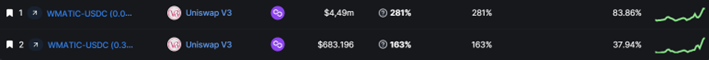

The choice of rate level is a crucial step that will directly impact the commissions we will earn. To simplify this process, it is effective to analyze the historical profitability on Defillama. Take, for example, the Matic/USDC pair on the Polygon network.

It is important to note that Defillama presents its data in a price range of +-30%. Therefore, we do not have to take the exact figure as definitive, but rather as a guide. It is advisable to examine the average of the last 30 days to avoid basing decisions on exceptional events that may be occurring at the time of analysis.

In the image we can see how, on a sustained basis, the pool with commissions of 0.05% gives us more yield. The next thing we have to choose is the price range.

As we can see, we can select a very narrow price range, greatly increasing the commissions. We can also select the full range, keeping a similar dynamic to Uniswap v2, where liquidity is not concentrated.

Finally, we have to choose the amount to deposit. When we select the amount of Matic we wish to deposit, Uniswap will indicate us the amount of USDC needed, depending on the range we have chosen.

Finally, we can use certain programs to monitor the yield we are generating. One of them is seedle finance. Although we will explore these aspects in more depth in future articles, it is advisable to use monitoring tools to evaluate the yield generated.

We hope this introduction is enough to get you started in farming through Uniswap, although you should never forget the risks involved and we always recommend doing more research before making any investment.

With this introduction we aim to provide a solid foundation for those starting out in Uniswap farming, although it is important to remember the associated risks and we recommend doing more research, both on Uniswap and on the token you are going to invest in before making any investment.

0 comentarios