How Growi.LP works from a financial viewpoint

How Growi.LP works from a financial viewpoint

Typically, stablecoins like USDC, USDT, DAI, BUSD, and others are considered low-risk assets, which means that opportunities for high yields on them are limited (with low risk comes low returns).

Growi.LP is a product that aims to maximize the possible yield from your StableCoins (SC) by scanning multiple options to find the best ones.

As we continue to develop the product, Growi.LP intends to engage in different types of investing, including liquidity provision, staking, lending, and more. In the initial iteration of the product, Growi.LP acts as a Liquidity Provider (LP).

Growi.LP as Liquidity Provider

To get a higher yield as a LP, according to the risk-return trade-off, we need to invest in pools that are not denominated solely in stablecoins (NSC = non-stablecoin). This increase in risk can be greatly reduced by hedging the NSC (you can find a quantification of this below).

Essentially, we invest in a pool of SC / NSC that does not depend on the price of NSC, as it is hedged. This allows us to strip the yield of the pool with very low risk.

As a short summary, what Growi.LP does acting as LP is:

Detects an opportunity [e.g.: a pool with a great risk-reward trade-off; “great” as per our proprietary algorithm]

Evaluate that opportunity with regards to the already existing ones in the protocol.

If that opportunity is considered acceptable, then we hedge the position with a future, to avoid as much as possible the influence of the price movement.

We monitor constantly the enforcement of the backstops to reduce as much as possible sudden lost of value of tokens, including the stablecoins, and we monitor also the existing investments, to ensure they are still profitable.

Rinse and repeat 🙂

With a bit more of detail, the algorithm behind Growi.LP works: (see picture below)

Analyzing weekly what tokens are suitable for being invested that week.

Allocating the funds according to a proprietary algorithm which takes into account not only the profitability, but the risk (volatility) associated to each position, and hedge each position.

Keeping the margins of the Future : for the hedged position, we constantly ensure the margins are kept safely

Enforcing backstops: to ensure that the protocol is protected against sudden lost of value of stablecoins or tokens.

Now we will explain each step of the process

Acceptance of tokens

Weekly, we analyze what tokens can be invested in, if following conditions are met:

The token has a perpetual future in the blockchain we are working on — it is “hedgeable”.

It is older than 6 months

It behaves as a “standard” financial asset:

— it fulfils in different time scales: σ(t) = σ · sqrt(t)

— probability of being out of the ±σ line is similar to other financial assets (Bitcoin, Ethereum, EURUSD, e.g.) [see graph below]

Allocating funds

This is our “secret sauce” — we evaluate the opportunities (LP, Staking, Lending) taking into account not what it is possible to earn in the short term, but also taking into account the risk (volatility) of that position and the ability of having a return on the future, and the properties of the perpetual future (liquidity, funding ratio).

Thanks to our algorithm, we are able to rank all of them, including the already existing sources of yield, to compare the new options with the existing ones.

As we work always with stablecoins, once the opportunities has been chosen:

we hedge the position of the tokens by selling a future

we do the appropriate swap of tokens, to ensure that the tokens that are NOT invested are in stablecoin, so there is no price fluctuation.

Hedging the non-stablecoins

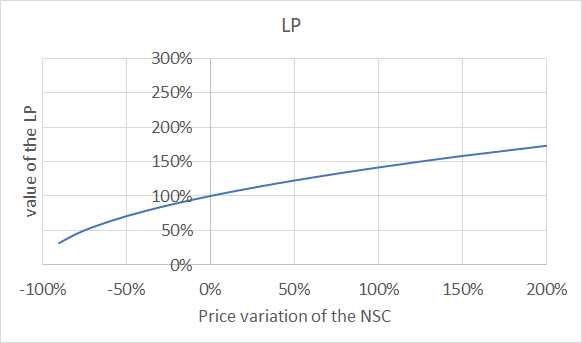

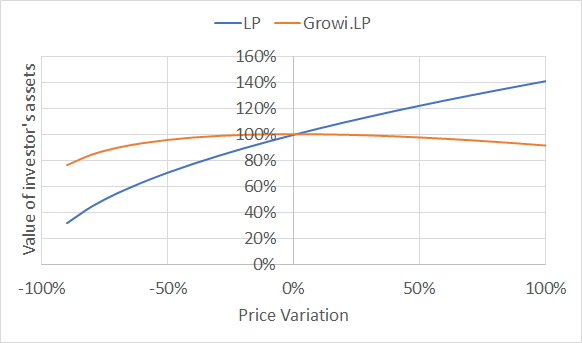

In a pool of SC and NSC, the value of the pool fluctuates with the price of the NSC, as can be seen in the following graph:

Hedging the NSC with a future allows to keep the value of the pool constant during a great price range, as can be seen here:

Which in practice allow us to get quite precisely the expected yield of that pool.

It is possible to even extend further the range of the price with additional hedging, to be assessed in further iterations of Growi.LP

Keeping the margins of the future

We hedge initially the position by selling a perpetual future. Once hedge, we need to keep the margin of the future.

Being compatible with the terms defined by the DeFi provider of the future, our preferred range of margin is between 12% and 17%.

Backstops

Stablecoins

Taking into account what happened to UST (Terra USD), it is needed to be alert to detect when a stablecoin has de-pegged from its reference (USD).

First thing we do to avoid this de-pegged problem is only accepting few well-established stablecoins, as it is USDC, USDT, DAI, (BUSD, depending on the blockchain were we launch).

Even though we set additional measurements to avoid a potential depeg from the aforementioned stablecoins.

Initially, we can analyze the price of different stablecoins against the USD: [it is important to notice that the y-axis and x-axis is different for each stablecoin]

It can be seen that when the stablecoins are “attacked” it is a sudden event — which can be measured, for example, taking into account the most recent volatility vs an average of volatility of the last month, e.g.

Although volatility alone cannot be used, as it has no “direction” — even if it is not desirable, having a stablecoin valued in more than $1 is not a big problem (if it does not last too much time). The problem comes when loosing value with respect to the $.

After analysing the most recent movements of all the accepted stablecoins, we have opted for defining a hard limit where, below that level, we consider the stablecoin has a big risk of loosing its peg with the $, so we close all the positions in that stablecoin and then change all that stablecoin to the other stablecoins.

For avoiding any undesirable consequence, we intentionally do not publish that level.

Tokens

Working on it — in principle not as urgent, as tokens are covered by the future — if there is a sudden lost of value it will be reflected on the future

Conclusion

All the previous steps allow us to offer an protocol that can get the maximum yield for your stablecoins, in a safe and simple way. Enjoy it as much as we’ve enjoyed developing it! 🙂

0 comentarios