Having a portfolio of investments in cryptocurrencies or tokens is all very well, but fortunately or unfortunately to buy goods or services…

Having a portfolio of investments in cryptocurrencies or tokens is all very well, but fortunately or unfortunately to buy goods or services we usually have to use fiat money and for that we must know how to sell our digital assets. In this article we will compare the main ways to transform cryptocurrencies and tokens into fiat money.

The two main ways to sell cryptocurrencies are by using a centralized cryptocurrency exchange platform (CEX) or by using a cryptocurrency buying and selling portal.

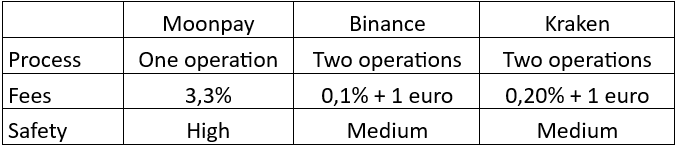

If we use a CEX we must sell our digital assets to transform them into fiat money and then send the fiat money from the platform to our bank account. Using a CEX has some advantages. The main one is that it is very cheap.

To give you an idea, Binance charges a commission of 0.1% for the sale of cryptocurrencies and for withdrawing our euros from the platform to our bank account it charges 1 euro if it is done through a SEPA bank transfer (cheaper method). At the same time, Kraken charges a 0.2% commission for the sale of digital assets and a 1 euro commission for withdrawing our euros from the platform.

At the same time, CEXs hold our funds at all times, whether in digital assets or fiat money, which is a risk and a negative aspect to consider. Therefore, what a CEX does to sell our cryptocurrencies is to find a buyer and be the intermediary.

On the other hand, the we must do two operations, first sell our digital assets and then withdraw the money from the platform. This makes it take longer to complete the conversion than if it were a single operation.

The main portal for buying and selling cryptocurrencies is moonpay. To sell cryptocurrencies through moonpay you simply send to a company wallet the amount of cryptocurrencies you want to sell, and then the company sends that amount minus commissions to your bank account in the form of fiat money.

As we see it is a very simple and safe, since moonpay does not custody our funds. The company acts as an exchanger of cryptocurrencies for fiat money, when they receive our digital assets they send us the money, so it does not hold our funds normally like CEX.

However, simplicity and security pay off. Moonpay commissions depend on the blockchain of the asset we want to sell, but in any case are substantially higher than those of CEXs.

Moonpay allows us to sell a wide variety of cryptocurrencies and tokens but there are also other portals for buying and selling cryptocurrencies, although these usually have a very limited supply of digital assets.

This would be the summary of all the aspects mentioned above:

As we can see, in order for the profits (or losses) to finally be reflected in the bank account, the investor must decide if the most important thing for him is the security and speed of operations or if he does not mind sacrificing a little of these to reduce the commissions he will pay.

0 comentarios