“The first rule is not to lose. The second rule is don’t forget the first rule.” — Warren Buffett

“The first rule is not to lose. The second rule is don’t forget the first rule.” — Warren Buffett

As one of the best investors of all times says, in order to be successful in investing the most important thing is not to lose money. That is why today we will explain what are the main scams in the world of cryptocurrencies and decentralized finance and how you can avoid falling prey to them.

Rug pulls

Rug pulls are one of the most common scams in the world of cryptocurrencies and decentralized finance.

It is a malicious practice that consists of the creators of a project capturing the investment of users to subsequently flee with the investors’ money.

The modus operandi is usually as follows: The creators of the project create a native token of the project in the form of shares keeping most of them and encouraging people to buy them. They are made to believe that the project is going to be very successful so that they buy the tokens, thus the price of the token increases a lot which attracts more buyers who think they can get great returns on their capital by buying the tokens.

Then, the creators of the project sell the large amount of tokens they have causing the price to plummet and obtaining large amounts of money. In the end the creators of the project disappear with the money and the rest of the investors are left with a token whose price is practically zero.

To avoid falling into this type of scams we must carry out a series of practices:

Understand the value proposition of the project, to assess with good judgment whether the price of your tokens is reasonable. The company’s website, social networks and documents usually contain all this information. If you do not understand what the project is about, it is best not to invest.

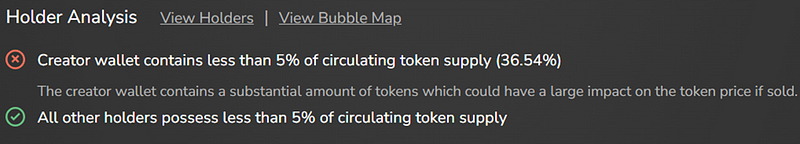

See if the creators of the project have a very large amount of tokens, so that if they sell it all at once it can cause the price to plummet. This check can be done with Tokensniffer by entering the token contract, which is usually found in the company’s documents. If they have a large amount, but are subject to a vesting period (period during which they cannot sell the tokens), it need not be bad.

See that the price of the token has not had a very large increase and in a short time as this can be artificially triggered by the founders and result in a price correction.

Do not rely on promises of monstrous returns on invested capital as they are used as a sweet to attract investment.

Liquidity pull

In order to buy and sell a token, there needs to be liquidity on a decentralized exchange. On the Ethereum network, for example, it is common for new tokens to be paired with ETH on Uniswap.

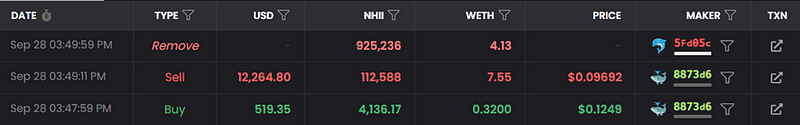

The creator of the contract provides the liquidity for the pair, although, if he does not block it, he can withdraw it at any time. In other words, if the creator withdraws the liquidity and you have bought that token, you will not be able to sell it later.

We can verify this type of movement on platforms such as dexscreener and tokensniffer.

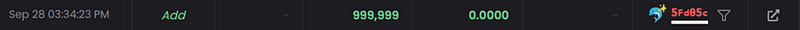

By analyzing the NHII token, these types of scams can be identified. If we log into dexscreener and paste the token contract, we can observe the movements. The token creator added liquidity at 15:34 and withdrew it at 15:49, after which no further movements were recorded.

Honeypots and sell fee

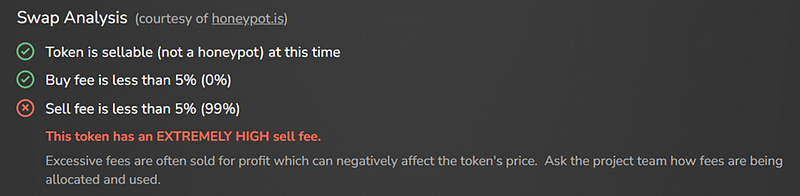

Another fairly common type of scam is to enable purchases of a token, but not sales. This allows the token to continue to be purchased and therefore the percentage increase in price appears very high, thus attracting potential speculators.

The inability to sell the token can be achieved by various methods, such as the use of a blacklist, the application of a high sales commission (often 99%), or the temporary blocking of the sell function in the contract.

To verify whether the creator of a token has carried out any of these practices in an attempt to defraud us, we can access tokensniffer.

Here we can see how, although the token can be sold, a 99% sales commission has been applied to it:

0 comentarios