AAVE is the most widely used lending protocol to date. In AAVE we can borrow assets by providing others as collateral.

This opens the door to many possibilities within decentralized finance, however, we must understand how it works in order to avoid any unpleasant surprises.

AAVE’s risk management

AAVE takes into account three types of risk to assess the quality of an asset as collateral for a loan.

Smart contract risk: This is the security of the code backing the asset. To measure it, AAVE relies on the maturity of the code, which it quantifies by the number of days that have passed since the code has been used and by the number of transactions it has executed.

Counterparty risk: Measures the quality and security of the asset’s governance. This consists of who has the largest share of the supply of the asset and who makes the decisions of the underlying protocol.

Market risk: This is the risk associated with the market around an asset. An asset’s market is made up of its market capitalization, volume, liquidity, fluctuations between supply and demand and volatility.

The parameters used by AAVE to measure market risk are market capitalization, volume and volatility.

With this information you can get an idea of the risk that AAVE will associate with the asset that you deposit as collateral.

Overcollateralization

The principle on which AAVE bases its lending is overcollateralization.

This means that in order to borrow from AAVE, you must first deposit collateral that is greater than the amount you want to borrow, otherwise you will not be able to access liquidity. If this relationship is broken once you have initiated a debit position, you will be liquidated.

The indicators or parameters that must be taken into account in order not to be liquidated are the loan to value (LTV), the liquidation threshold and the health factor.

The LTV formula is shown in the image. AAVE establishes an LTV value for each asset so that you can know the maximum amount you can borrow with a given collateral.

If your LTV is higher, then it is possible that AAVE will liquidate part of your position and keep your collateral.

For those assets that AAVE considers less risky the LTV is higher and for those assets that AAVE considers riskier the LTV is lower.

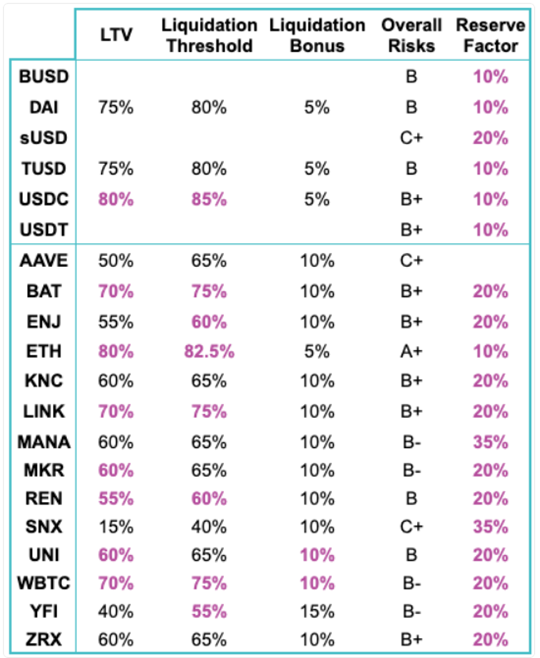

The liquidation threshold is a percentage below which AAVE considers a loan to be undercollateralized, which would result in the liquidation of that loan.

AAVE leaves a small margin between the LTV and the liquidation threshold to give some resilience to borrowers.

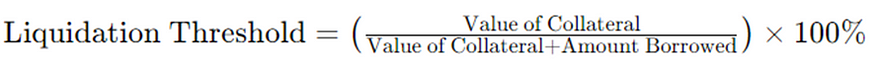

Here are some LTV and liquidation threshold values that AAVE assigns to some assets.

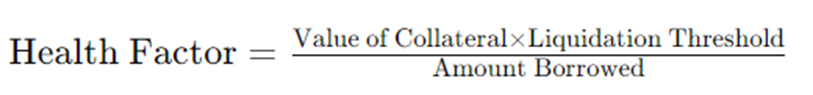

Finally, the health factor is what you will see in the AAVE interface when you borrow. To initiate a debit position you must provide enough capital to bring the health factor above 1 and you must keep it above 1 during the loan.

If the health factor is less than 1, AAVE will use part of your collateral or all of the collateral you have deposited to repay part or all of the loan and reduce your debtor position.

How to avoid being liquidated

We have already seen that, in order not to be liquidated, what we must do is to have a health factor above 1 and keep the liquidation threshold at bay.

On the one hand, you must be careful with the assets you deposit as collateral and with those you borrow. If they are very volatile, the value of your collateral and your debt may change rapidly and therefore your health factor.

On the other hand, there are tools you can use to monitor your health factor without having to go into AAVE every day, such as Hal and DeFi Safer.

With these tools you can set up notifications that alert you when your health factor falls below a certain value or tell you the value of your health factor every day or even every hour.

0 comentarios