Every four years, the Bitcoin ecosystem experiences a seismic event known as the halving. Much more than a mere technical event, the halving represents a pivotal moment that determines Bitcoin’s trajectory.

As the next halving approaches, let’s take a closer look at what it means, why it’s important, and what we can expect from this event.

Definition and purpose of halving

Bitcoin halving is a change in the Bitcoin protocol whereby the rewards miners receive for creating blocks are halved.

It happens automatically because it is programmed into their code.

It works as a kind of countdown that ends when 210,000 blocks are created, then the miners’ rewards are halved and the countdown starts again.

It usually takes about 4 years to mine 210,000 blocks, so it is estimated that Bitcoin halving occurs every 4 years.

The purpose of halving is to maintain the scarcity of Bitcoin by reducing the rate of Bitcoin issuance.

New Bitcoins are only created when miners are rewarded for validating transactions and creating new blocks. Thus, by halving the reward they receive, the amount of Bitcoins issued is halved.

In the end it comes down to the fact that, after halving, the next 4 years half as many Bitcoins will be created as were created the previous 4 years and so on.

Historical Moment

There have been 3 halvings in the past.

The first was in November 2012, when the rewards for miners went from 50 Bitcoins to 25. The second was in July 2016, reducing the rewards down to 12.5 Bitcoins and the third was in May 2020 leaving the rewards for miners at 6.25 Bitcoins.

This is the point at which we are currently at.

The next halving is estimated to be in mid-April, in about a week’s time and the rewards miners will receive thereafter are 3.125 Bitcoins per block.

In theory, halving would come to an end in the year 2144 when the entire Bitcoin supply is unlocked.

Bitcoin halving is a widely followed event by many because historically, it has had a positive impact on the Bitcoin price.

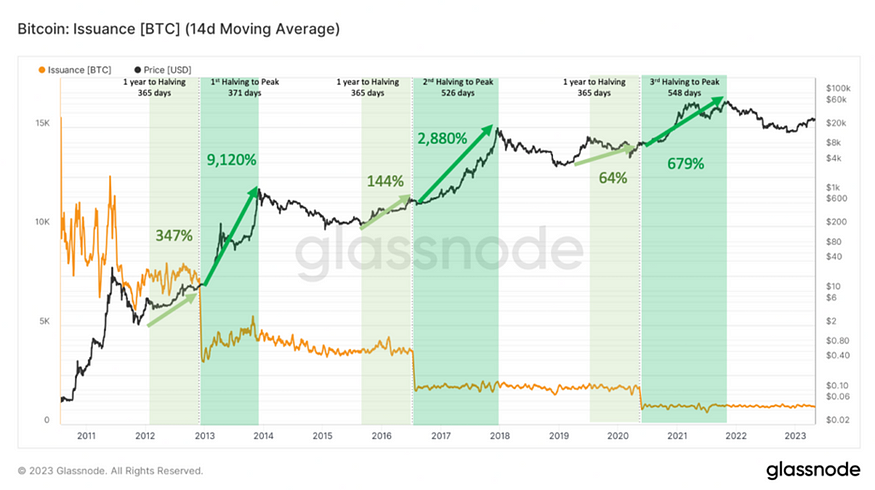

As we see in the chart, both a year before and a year after the halving, the Bitcoin price undergoes large revaluations.

This is because halving assumes a very substantial reduction in the future supply of Bitcoin.

The price of an asset is formed by taking into account its supply and demand, if from one day to the next the supply increases at a much slower rate than it has been increasing and the demand does not decrease to the same extent, then the price skyrockets.

On the other hand, we have speculative leverage.

Since halving has led to substantial increases in the price of Bitcoin in the past, many speculators believe that this could repeat itself and prepare for it by buying Bitcoin.

This in turn, attracts more speculators, so that before and after halving the Bitcoin price increases due to buying pressure.

Finally, halving can also act as a reminder of Bitcoin’s value proposition. That lies in being a P2P currency with a maximum supply limited to 21 million units.

In a world where every few years we experience large currency prints and increases in inflation, Bitcoin shines as an asset that is becoming increasingly scarce, attracting investors who want to hedge against inflation and uncertainty.

Next halving

As we have already mentioned, the next halving will take place shortly and it will have its particularities.

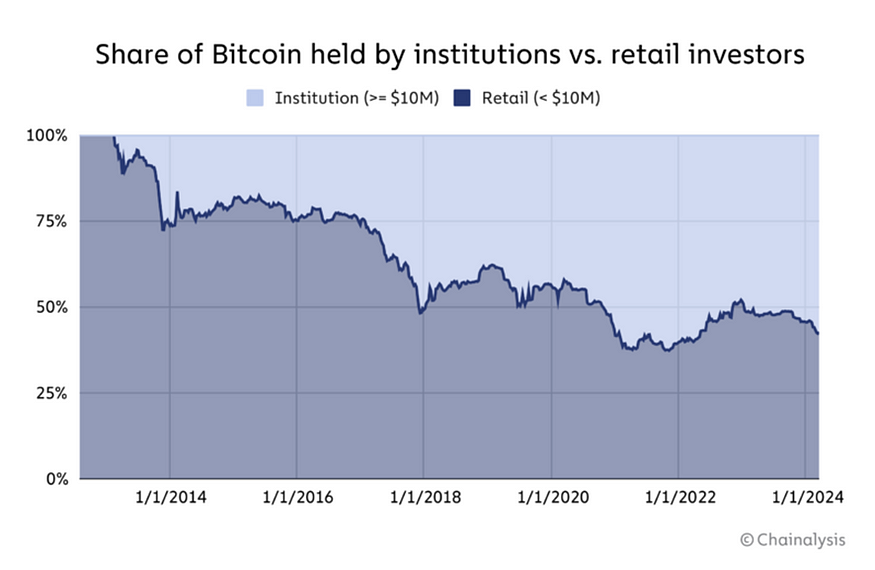

As we can see in the chart, the percentage of Bitcoin supply held by institutional investors is over 50%.

It is quite possible that this is due to the entry of ETFs into the crypto landscape and has certain implications.

For starters, there is the possibility that the adoption of Bitcoin by such reputable firms as Blackrock and Ark Investments could increase the confidence of more institutional and individual investors in this asset.

These could become new buyers of Bitcoin and thus lead to more buying pressure.

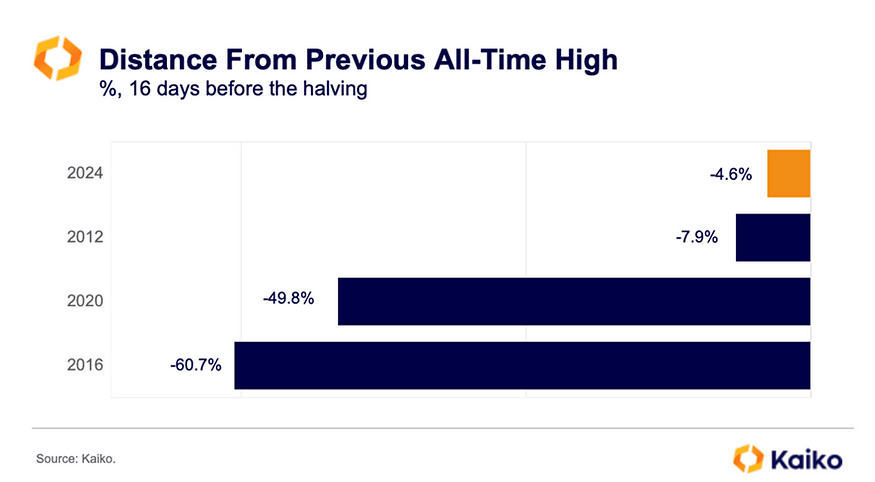

Second, Bitcoin ETFs have raised billions of dollars since their approval in January 2024. This has driven the price of Bitcoin sharply higher prior to halving and as seen in the chart, this is the time the price is closest to highs.

The Bitcoin price may not experience as large a revaluation as on previous occasions due to the fact that it has already experienced a good revaluation just before halving.

0 comentarios