Step-by-step guide to buy stablecoins.

Step-by-step guide to buy stablecoins.

In this article we explain what are stablecoins and how they work, what is the safest way to buy them and the steps to follow. If you already know what stablecoins are, you can go directly to point 3 to see the guide to buy stablecoins.

What are stablecoins and what are the main ones

Stablecoins are cryptocurrencies pegged to the price of an asset, i.e. one unit of stablecoin has the same value as one unit of that asset. Most commonly, the asset in question is the US dollar, but they can also be anchored to the price of the euro and other currencies or commodities such as gold.

Stablecoins are usually created by companies, which are responsible for maintaining parity with the underlying asset by issuing or deleting them. Although there are also others that are not controlled by an entity, but operate in a decentralized manner.

Right now we find three main stablecoins in the crypto ecosystem by market capitalization, which are USDT, USDC and DAI. The first one was created in 2014 as the first ever stablecoin, it is issued and backed by Tether and works as follows: When an individual or legal entity deposits a dollar amount in Tether, the company creates the same amount of USDT minus fees and gives it to the person.

In the same way, when a natural or legal person deposits an amount of USDT in Tether, Tether returns the same amount of dollars to the user and destroys the USDT deposited by that person.

USDC works the same way only that the company behind this cryptocurrency is Circle instead of Tether.

DAI, however, is different. It is a decentralized cryptocurrency, i.e. it is not backed by a company, but a platform formed by a set of smart contracts that is responsible for carrying out the process explained above automatically.

Why buy stablecoins in a decentralized way

To buy stablecoins we can do it directly in the mentioned companies like Tether or Circle, although this option is not very affordable. To begin with, in Circle you can only create an account if you have a company or if you are a developer working in one. In Tether we can create an account, but they have a very aggressive KYC (Know Your Client) policy, so the user has to give a lot of data and even pay to verify your account and also the minimum purchase is $ 100,000.

Another option is to use platforms to buy and sell centralized cryptocurrencies such as Binance or Bit2Me. The problem is that using these platforms you also have to go through a long and tedious identity verification process.

As we can see, with these options a company has our data and control of our funds, which is very dangerous (see FTX case).

Therefore, we can only buy DeFi, i.e. buy stablecoins through platforms for buying and selling decentralized cryptocurrencies. These platforms work automatically through smart contracts, so that no one person decides what happens to our funds. At the same time, we do not have to give our personal data.

Steps to follow to buy stablecoins

To buy stablecoins we will use the protocol called Uniswap, a decentralized platform and we will use the USDC stablecoin as an example.

1. First access Uniswap through this link. Or go to the uniswap.org website and click the Launch app button on the top right.

2. Next, look at the top right corner, where you will see a button that says connect and a dropdown with the Ethereum symbol.

Click on the ‘Connect’ button to connect the metamask portfolio and open the drop-down to click on Optimism. If you don’t have a metamask wallet or don’t know what it is, we explain it in this article.

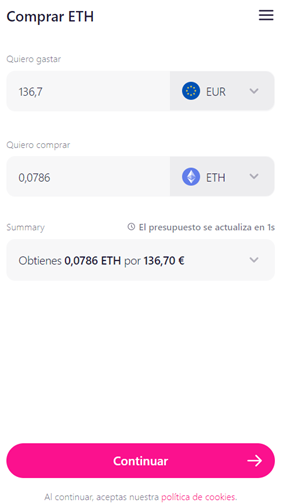

3. Once the metamask wallet is connected, click on the buy button in the center and this screen will open.

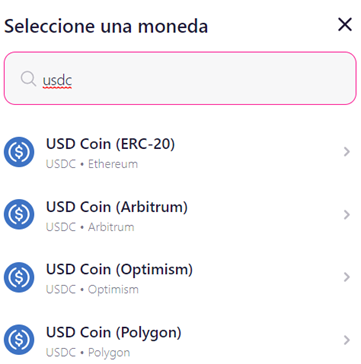

Now you have to open the dropdown where it says ETH and search for USDC. You will get 4 options:

Select USD Coin (Optimism) as this network offers competitive commissions and is the one through which you can interact with our protocol.

Finally put the amount of USDC you want to buy and the platform will indicate the amount of euros you must pay. If you click on the “Summary” dropdown you will see the commissions (usually 2.5%).

4. To pay you have to click on the ‘Continue’ button, follow the instructions and choose the payment method.

Stablecoins are an asset that plays a very important role in the crypto ecosystem. Knowing their characteristics and how they work, knowing how and where to buy them will open many doors to decentralized finance.

0 comentarios